By Smoking Gun

At the time of writing, gold is trading below 1200. Why the sudden exodus from the yellow metal? It seems that all seemingly good news for gold has been ignored while every little bits of adverse news for gold has been reason for bears to double down their short bets and shoot down gold to bits.

Even this obscure piece of research which first appeared a year ago by an even more obscure business professor who argues that the fair price of gold should be trading closer to its "fair value" of USD800/oz has now caught on fire with the gold bears.

Below is a reproduction of the news article;

KITCO NEWS INTERVIEW: Gold Prices Could Tumble Further -- Duke Professor

Comment Now

Follow Comments

(Kitco News) - Gold prices fell to roughly $1,220 an ounce Wednesday, nearly a three-year low, and further downside may be possible for the metal.

That downside could be a longer-term move for gold, too, as the metal may be moving back to its fair value, according to Campbell Harvey, professor at Duke University’s Fuqua School of Business, who has done academic research regarding the value of gold.

Harvey’s research puts the long-term fair value of gold at $800 an ounce, which is about $400 an ounce lower than current prices.

Fair value is “an average, so to get to the average, there are prices above and below it. We’ve been above it for a number of years,” Harvey told Kitco News.

That means there is “considerable downside here,” Harvey said, given that prices don’t necessarily go to fair value and sit there.

Gold has a tendency to be very volatile in the short-term, but is a good store of value in the long-term, he said, with “long-term” defined by centuries.

In a research paper he published along with Claude Erb, the two authors looked at the accuracy of some commonly held beliefs about gold. Using examples through history, Harvey and Erb showed that gold can be a good store of value in the extreme long term, but is too volatile to be a reliable inflation hedge for most people’s investing time frame. Those are two of the top reasons people hold gold in their portfolios.

In one example, the authors compared the salary of a Roman centurion to the annual salary of a U.S. Army captain, and found that the annual pay is almost similar. A U.S. Army captain makes about $46,000 a year, while a Roman centurion received the equivalent of 38.58 ounces of gold annually. Using the current $1,220 an ounce as a price, 38.58 ounces comes out to be about $47,000.

The salary comparisons were the most interesting part of their research, Harvey said, and it shows that gold is a good store of value over thousands of years. The problem is, no one lives that long.

He was quick to point out, however, that he is not anti-real assets investing. Specifically, he said a diversified portfolio of real assets, which can include gold, helps to offset unexpected spikes in inflation. He said owning a commodity index will do a better job than holding just gold.

“I have absolutely no problem whatsoever in having a diversified portfolio that contains some gold. Yes, if you had a lot of time to figure out which commodity is above or below fair value, (it would be better) but most people don’t have that luxury,” he said.

His point was that owning a single commodity to hedge against inflation, in this case gold, is not unlike owning a single stock and calling it a diversified equities portfolio.

Their original research paper was published a year ago, but since gold’s price plunge the research paper picked up more interested readers, he said, and is the most downloaded paper of his 20-plus year career. He and Erb updated their paper in May to include new research, including a look at different examples of how gold reacts during many hyperinflation environments.

They studied 56 different countries that experienced hyperinflation in the 20th century to document gold’s effectiveness as a hedge during those times. They concluded it depended on how gold was trading globally at that time as to whether it was a good inflation hedge.

While many point to Germany’s Weimar Republic during 1922-23 as the ultimate example of rampant inflation, there are more recent examples to consider, he said. One case is Brazil from 1980-2000. During those 20 years, the average annual inflation rate was about 250%, Harvey and Erb’s research stated.

For investors who stashed cash under a mattress, those people lost 99.97% of the value of that currency because of multiple devaluations and changes in the currency. Brazilians who bought gold and held it for those 20 years saw the real price metal lose 70% of its value, according to the IMF’s measure of Brazilian inflation, Harvey said.

“Note, this is not a short horizon situation; this was 20 years…. You would have been far better off rolling over your money in interest-bearing deposits. You would have still lost, but you wouldn’t have lost 70%. Of course there would be some risk of default,” Harvey said.

Brazil’s situation shows that gold did not perform the way most people expect gold would have acted during hyperinflation, he said. The South American country’s hyperinflation coincided with gold’s global price decline, which he said underscores how volatile the gold price is, even over the span of 20 years. Had Brazil’s hyperinflation occurred at another time, the outcome would have been different.

“If the Brazilian hyperinflation would have been from 2000 to 2013, gold would have been fabulous, even with the current price break. It would have looked great,” Harvey said.

While the Brazilian example is one of gold not performing as expected during hyperinflation, some other countries that experienced hyperinflation when gold prices were rising made the metal look like a good hedge. Harvey said that inconsistency proves his point.

“How gold acts is highly dependent upon the actual hyperinflation period. Because gold is so volatile it would be an unreliable hedge for regular unexpected inflation and hyperinflation,” he said.

My take on this is that this article is blah as it fails to account for the costs of extracting the finite precious metal from the ground. All it does is to debunk the hypothesis that gold is a inflation hedge. Whatever has been said about gold, it is probably one of the most unreliable inflation hedges around.. If someone did a paper comparing the price of gold and the relationship with the costs of extracting gold over time, that may be more meaningful but I doubt that such datas would exist as the only meaningful data would be recent times, and especially when gold prices were kept artificially low when governments banned the individual ownership of gold in the not to distant times. While it is true that during times of irrationality and market panic, prices may go below the cost of production, as experienced by other asset classes such as soft commodities and even real estate (during property busts, property prices are often below replacement costs) but this values wont be permanent as there wont be any profit seeking enterprise willing to produce at below marginal costs levels.

A colleague sent me this chart below today which is self explanatory. Over the past 6 years, gold prices have always trended above their marginal cash costs. During the height of the global financial crisis, gold prices tumbled just above the marginal cash costs before rebounding and resuming its upward trend.

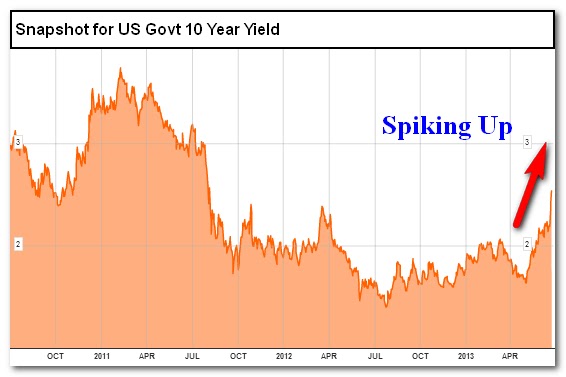

Some may argue that gold does not have industry use value and basically its the most useless of all metals except as a store of value and inflation hedge. With the perceived opportunity costs of holding the metal rising, it makes the bears' case compelling. Yes, there is a case for further weakness in prices, but in my opinion, the price has been too severely battered to warrant for this swift and sudden fall from grace. Look, no one's going to produce any gold if the cash costs are higher than spot prices. You are probably looking at marginal players shutting up shop altogether and the majors hoarding gold. Take that physical supply out of the equation and you may see a lack of sellers at this levels. The investment demand for gold only represent probably around 20% of the total demand for gold. As it stands, most of those who wants out has already done so. The bottom should be not far away from here. The world economy is still not out of the woods yet, the US may look better, but the economy is not as robust as it looks, external black swans abound... Eurozone, China may pull it back down, so the easing conditions should remain for a bit longer. If the Feds wants to pull the plug on the QE, they will... but they just won't tell you exactly when.. the worst thing for them to do is to pussy foot ala Japan, which hasn't really wised up to its past follies... as demonstrated by Abe's super-push only to now hold its horses and resume its very Japan-like attitude of waiting and seeing and wait a bit ah..